From Investments to Itineraries

Traveling the world is a dream many of us share, but turning that dream into reality often hinges on one crucial factor: funding. While saving diligently over time is one method, savvy travellers are increasingly leveraging their investment savings to finance their adventures. By strategically planning and making the right financial moves, you can transform your investment withdrawals into memorable travel experiences. Here’s how you can do it.

Understanding Your Investment Options

Before embarking on your journey, it’s crucial to understand the various investment options available to you. In the UK, popular investment vehicles include Stocks and Shares ISAs, pensions, general investments, savings accounts, and mutual funds. Each of these has its own set of benefits and considerations.

The value of Stocks and Shares ISAs, for instance, has seen substantial growth. According to HMRC, the market value of adult ISA holdings amounted to £741.6 billion at the end of 2022, with Stocks and Shares ISAs making up £459.8 billion of this total. This highlights a significant pool of resources that can potentially be used for major expenses, such as travel.

Setting Your Travel Goals

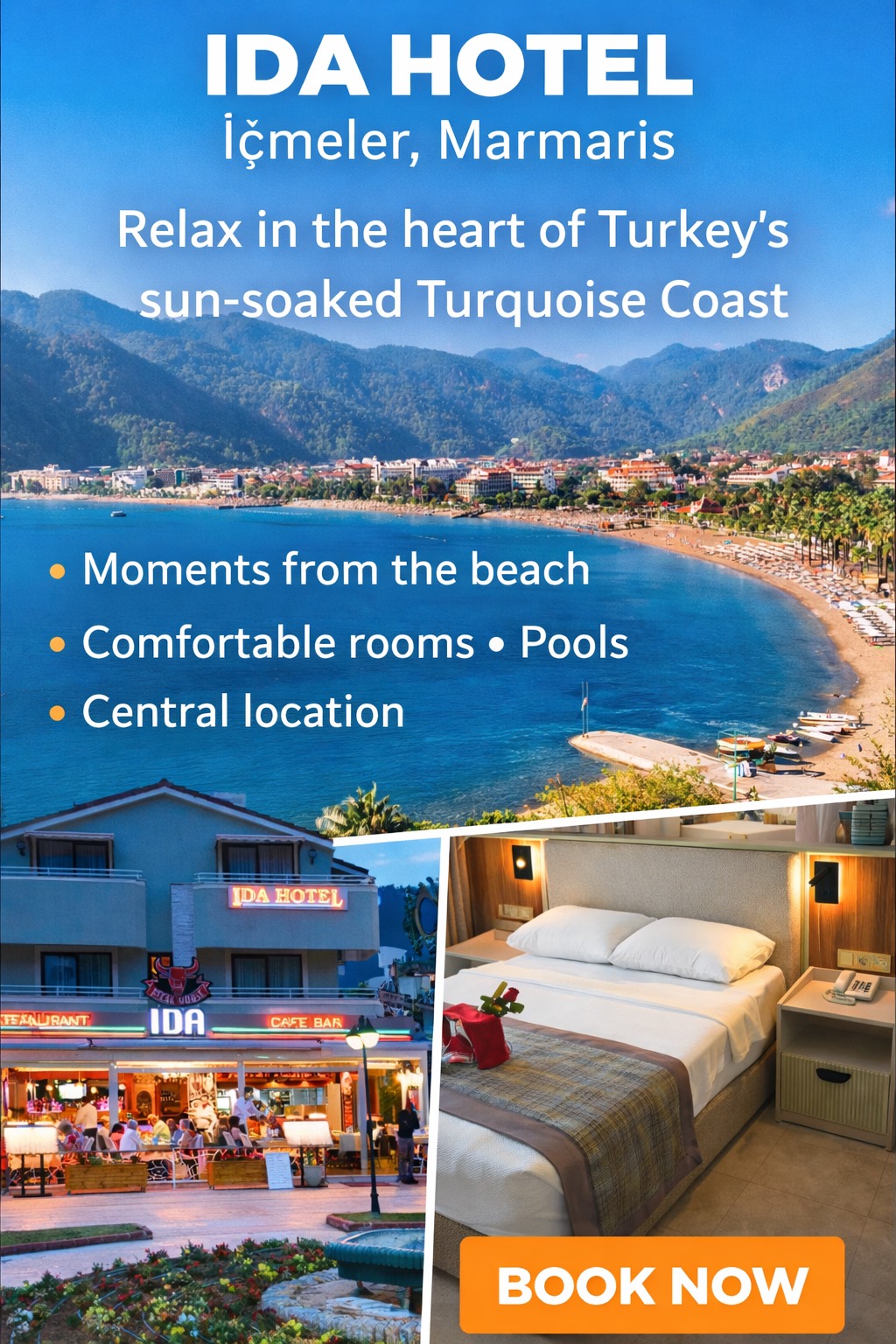

The first step in planning a trip funded by your investments is setting clear and realistic travel goals. Determine your destination, the experiences you wish to have, and the duration of your trip. This will help in estimating the total cost. According to a report by ABTA, the UK holidaymaker is spending more on holidays despite the unrelenting high cost of living. The average UK holidaymaker spends around £369 per person on a short holiday in abroad and £660 for a longer holiday. This can serve as a benchmark to help you budget your adventure.

Creating a detailed budget is essential. Account for all potential costs, including flights, accommodations, meals, local transportation, activities, and insurance. Websites like Numbeo can provide updated cost-of-living data for various destinations, helping you fine-tune your budget.

Timing Your Investment Withdrawals

Strategically timing your investment withdrawals is crucial to maximizing your funds. Withdrawing during a market peak can enhance the value you extract from your investments, while doing so during a downturn might diminish your savings.

For example, the FTSE 100, which tracks the 100 largest companies on the London Stock Exchange, can fluctuate significantly. Keeping an eye on these market trends can help you choose the optimal time to make your withdrawals. Moreover, the 2022 Investment association annual survey reported an average annual return of 11% on UK equities over the past decade, which suggests that carefully timed withdrawals can substantially benefit your travel budget.

Navigating Tax Implications

Investment withdrawals can have tax implications, which vary depending on the type of investment account. In the UK, Stocks and Shares ISAs offer a significant advantage as withdrawals from these accounts are tax-free. This makes them an attractive option for funding your travels without incurring additional tax liabilities.

However, other investment types, such as general investments or pensions, may have different tax rules. It’s advisable to consult with a tax advisor to understand the specific tax implications related to your withdrawals and to ensure you are optimizing your financial strategy.

Making the Most of Your Savings

Once you’ve withdrawn your funds, maximizing your savings becomes the next important step. One effective strategy is to use a travel rewards credit card for your expenses. Cards like the British Airways American Express or the HSBC Premier World Elite offer substantial points or cash back on travel-related purchases, which can be used to offset future travel costs.

Additionally, booking your accommodations and flights through platforms like Airbnb and Skyscanner can often yield significant savings. Skyscanner, for instance, reported that booking flights on a Tuesday can save travellers up to 15% compared to other days of the week.

Final Thoughts

Using your investment savings to fund travel is a smart way to leverage your financial resources. By understanding your investment options, setting clear travel goals, timing your withdrawals carefully, and navigating tax implications, you can ensure that your savings go the distance.

Traveling enriches your life with new experiences and memories. With careful planning and strategic financial moves, you can transform your investment savings into an adventure of a lifetime. So, start planning, pack your bags, and get ready to explore the world, all backed by your well-managed investments.