How to Fund Your Dream Trip Without Dipping Into Your Emergency Fund

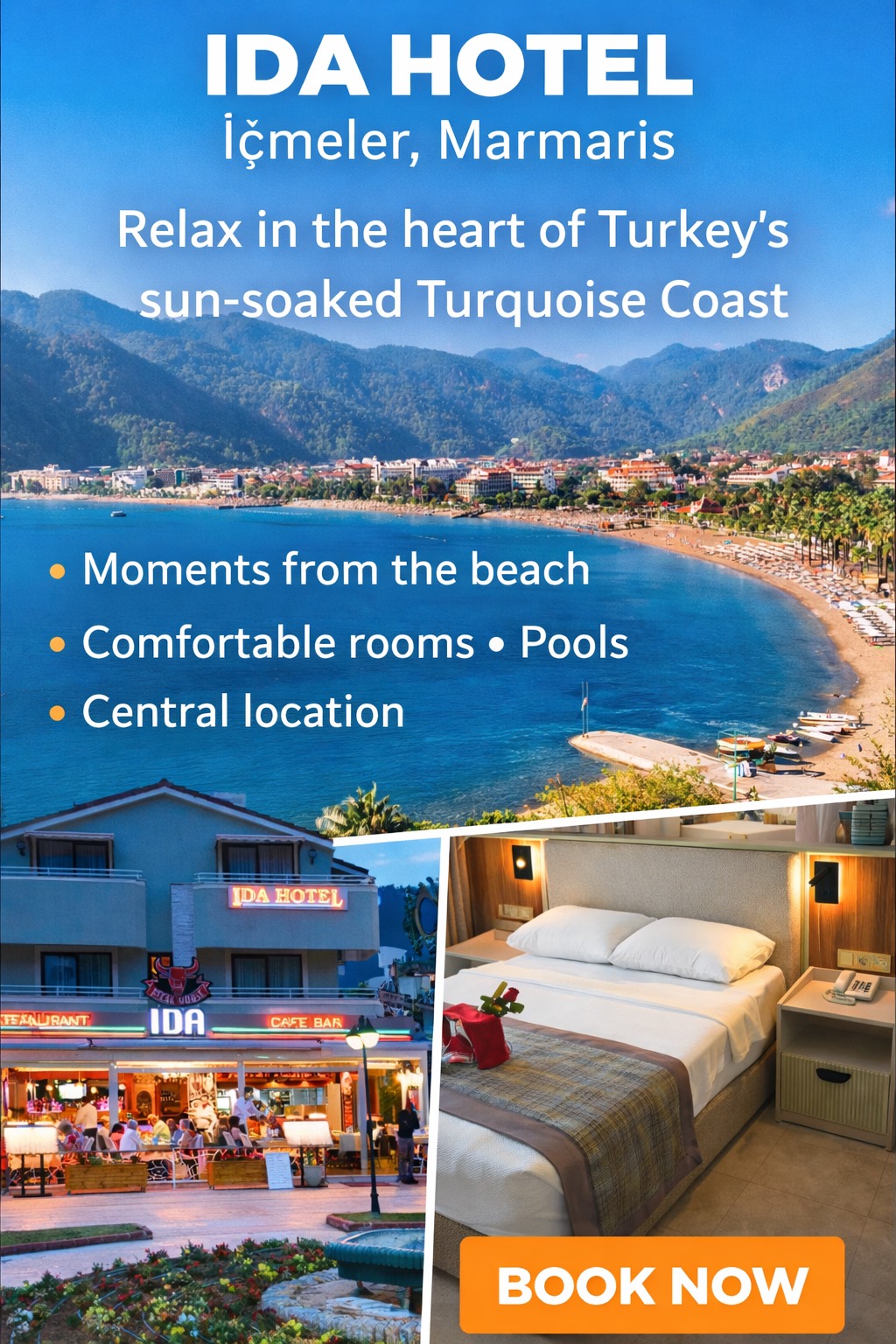

So you’ve been scrolling through photos of turquoise beaches, scenic train rides, or neon-lit night markets and thought: I need to go. The wanderlust is real, but so is the dent in your savings account.a

Let’s be honest. Travel isn't always cheap. Flights, accommodation, food, excursions… it adds up fast. And while you might be tempted to raid your emergency fund, take out a quick loan (or worse, throw it all on a credit card), there are way smarter ways to save for that dream trip.

The good news? You don’t need to be a finance guru to make it happen. You just need a plan…and maybe a little help from a few tools.

Step 1: Pick a Real Number

Before anything else, figure out how much your trip will actually cost. Break it down:

- Flights: $500? $900? (Use Google Flights or Skyscanner to estimate)

- Accommodation: Hostels, hotels, or Airbnb?

- Daily food + fun: Be honest - will you be dining on street food or booking that five-course tasting menu?

- Extras: Insurance, visas, airport transfers, souvenirs

Add it all up and round up a little. That’s your goal.

Step 2: Set a Timeline

Let’s say you want to go in six months and you’ll need £1,800. That’s £300/month or £75/week. Seeing it like that makes it way more manageable, and it’s less likely to throw your whole budget off balance.

Step 3: Open a "Hands-Off" Travel Fund

If your travel savings live in the same place as your rent and groceries money, it’s probably going to get accidentally spent.

Open a separate savings account just for travel. Set up an automatic weekly or monthly transfer so it builds up without you thinking about it.

Bonus: Use a savings app like Monzo, Plum, or Revolut that lets you "round up" spare change. You won’t miss the small amounts, and they’ll quietly grow into real money.

Step 4: Boost Your Budget (Without Burning Out)

Here’s the part most people skip: adding money instead of just cutting back.

There are tons of flexible online jobs and side hustles that can give your travel fund a nice boost without taking over your life. Some solid options:

- Freelancing: Writing, graphic design, tutoring - whatever you’re good at.

- Virtual assisting: Helping people manage emails, scheduling, or social media.

- Selling stuff: Declutter and list on Vinted, Depop, or Facebook Marketplace.

- Online gigs: Survey sites, user testing, or digital microtasks.

Not sure where to begin? Platforms like Prograd, Steady, or even job boards like Fiverr and Upwork can help you discover opportunities that match your time, interests, and skills. Some, like Prograd, let you set a goal, like saving for travel, and recommend ways to get there faster, whether that's through income ideas or smarter saving tools.

Step 5: Cut Costs (Not Joy)

You don’t have to go full no-spend challenge (unless you want to), but rethinking a few habits can free up extra money fast:

- Swap a couple of takeaway coffees each week for home-brewed ones.

- Pause any subscriptions you don’t really use.

- Take public transport more often or share rides.

- Cook at home a few extra nights a week.

You’ll still enjoy life and see your travel fund grow.

Step 6: Stay Motivated

Make your travel goal visible. Print a photo of your destination. Use a countdown app. Track your savings in a way that’s satisfying to look at. Keeping that “why” front and center helps when you're tempted to splurge.

Saving For A Trip

You don’t need a big salary or a loan to see the world. Just a bit of planning, some clever saving strategies, and a few extra income tricks. Whether it’s through a side hustle, a round-up app, or a smart app, funding your dream trip is way more doable than you think.

Future you - on that beach, mountain trail, or night train - is already thanking you.