How you can save money on your next family holiday

There’s no doubt many Brits are trying to cut back on spending where possible, but does this mean you need to put off that family holiday you’ve been dreaming of?

New research from HSBC UK has revealed how Brits are managing their finances ahead of and while jetting off abroad. Interestingly, despite the cost-of-living crisis, the survey of over 2,000 individuals revealed nearly three-quarters (71%) of respondents are in pursuit of a getaway abroad this year.

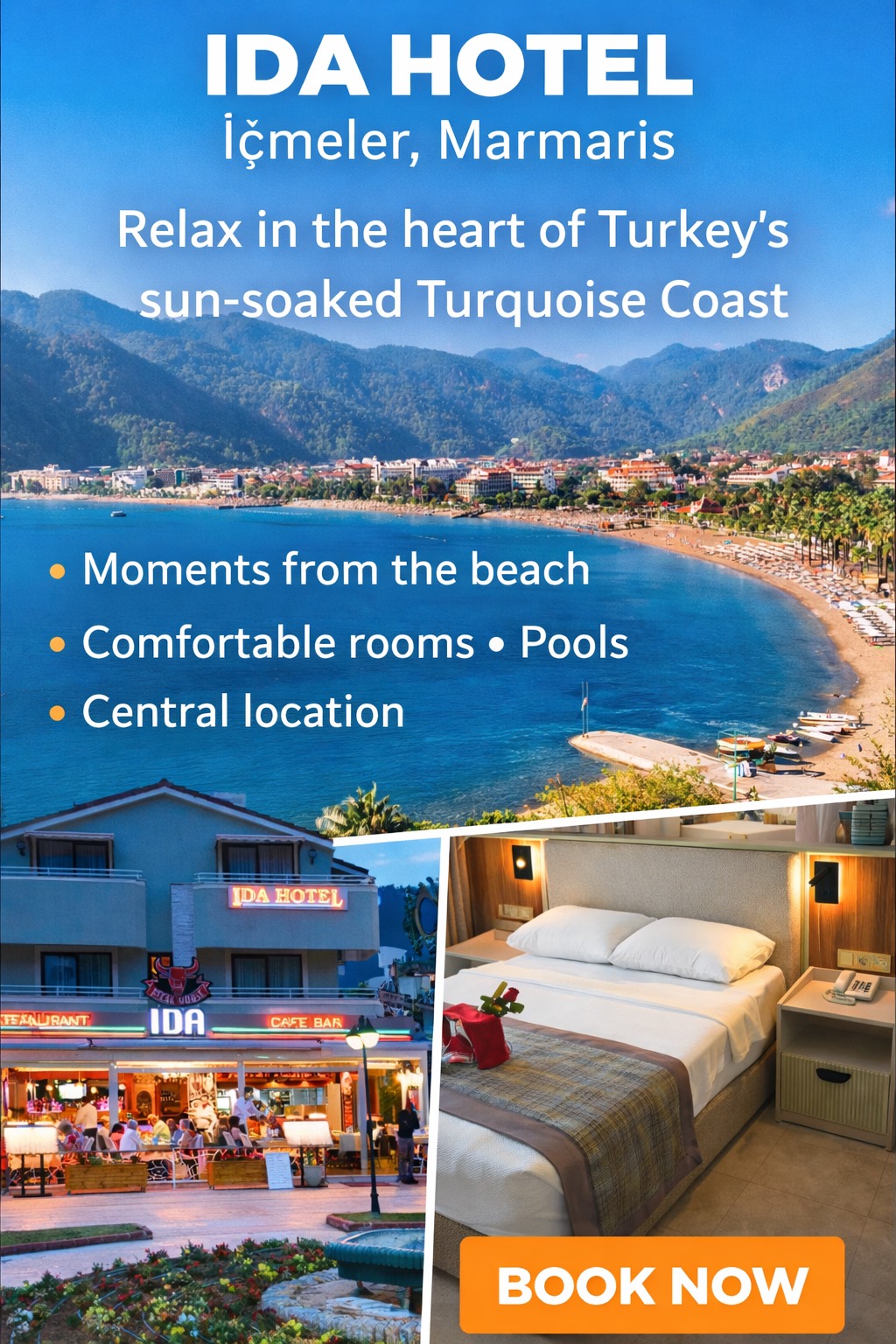

The survey revealed top destinations for travellers are Spain, Italy, Greece, the U.S, and France dominating the travel wish list of Brits this year.

If you are planning on going away with the family this year, here are some key tips on how you can save money:

- Ahead of your trip cut down on unnecessary expenses and start saving up. In HSBC’s study, we learned Brits are cutting back on eating out by 31%, reducing nightlife expenses (27%), and saving more each month (29%) before they go away, ensuring they have more funds while abroad.

- Quantity not quality – although a reverse of the common phrase, HSBC found nearly half of holidaymakers (46%) would choose a budget holiday with a longer stay instead of splurging on luxury trips.

- Know your holiday exchange rate. While Brits are conscious of credit card fees when abroad, a significant portion of Brits (35%) admit to not knowing their expenses due to their unfamiliarity with exchange rates. This means Brits could potentially be in the dark of what they’re actually spending.

- While on holiday – Brits implement a range of tactics to ensure they’re staying on budget, including setting aside a certain amount of cash per day (32%), setting money aside for unexpected expenses (27%), prioritising spending based on budget and interests (25%), tracking spending on a banking app (21%) and looking for low-cost activities (19%).

- Research how you’d like to pay. Depending on your travel habits, the best way to spend your funds may vary. HSBC’s study found local currency cash is preferred by 27%, followed by debit cards (23%), credit cards (18%), and prepaid currency cards (10%).

For more information on spending and saving money abroad, please see here.